In Q2 2025, following a deep correction in Q1, the cryptocurrency market began to show signs of recovery, primarily driven by inflows from ETF products and a strong rally in Bitcoin. On the policy front, expectations of a Federal Reserve rate cut and improving U.S. employment data contributed to a partial recovery in market sentiment. However, geopolitical tensions and sluggish global economic growth continued to limit a broader rebound. By the end of Q2 2025, the total crypto market capitalization had rebounded to approximately $3.46 trillion, marking a quarter-on-quarter increase of around 28.2%.

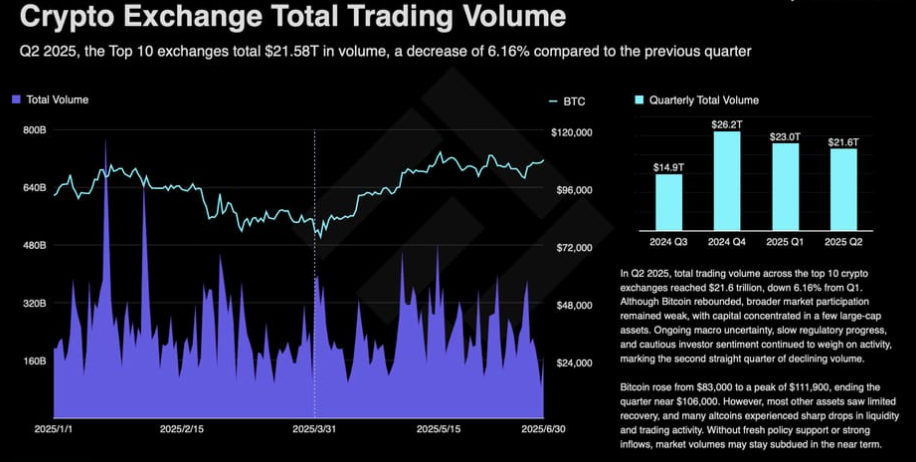

Bitcoin rose from $83,000 to a peak of $111,900, ending the quarter near $106,000. However, most other assets saw limited recovery, and many altcoins experienced sharp drops in liquidity and trading activity. Without fresh policy support or strong inflows, market volumes may stay subdued in the near term.

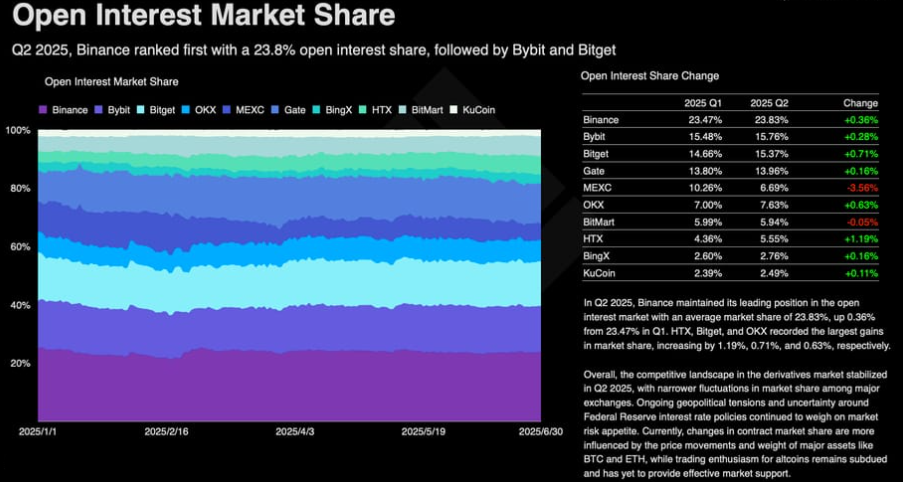

Five exchanges saw market share growth this quarter: OKX, Bitget, HTX, Gate and KuCoin. Gate led the gains with a 2.55% increase, followed by OKX with 1.08% quarter-on-quarter growth.

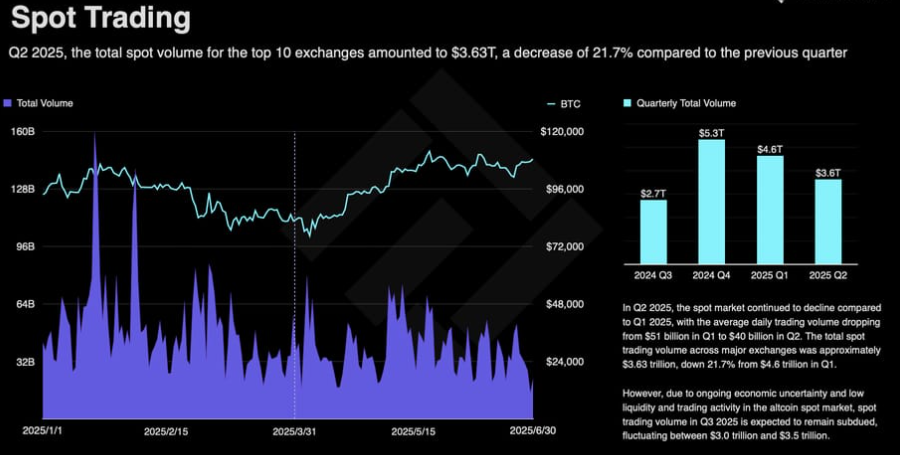

Traders maintained their Q1 preference for high-frequency derivatives trading amid market uncertainty, aiming to hedge risks and leverage volatility. This trend also underscored a sharper downturn in the spot market, as liquidity and trading activity in many altcoins dropped significantly, in contrast to the relative resilience of derivatives markets.

However, due to ongoing economic uncertainty and low liquidity and trading activity in the altcoin spot market, spot trading volume in Q3 2025 is expected to remain subdued, fluctuating between $3.0 trillion and $3.5 trillion.

Although market sentiment was briefly lifted in early April by the Federal Reserve’s decision to pause rate hikes, concerns over global economic slowdown and geopolitical tensions continued to dominate investor behavior. Average daily trading volume declined to $226 billion in Q2, down from $233 billion in Q1, indicating a further weakening of risk appetite.

On one hand, BTC rallied strongly on the back of inflows from spot ETFs and greater regulatory clarity in the U.S., but exchange tokens failed to benefit from the same momentum. On the other hand, exchange tokens remain closely tied to the altcoin market, where trading activity and liquidity declined notably during the quarter—further weakening support for platform tokens. Looking ahead, the performance of exchange tokens is expected to remain divergent in Q3 2025.

Good trades Traders.